In recent years, Dubai has made significant strides towards transitioning to renewable energy. With its abundant sunshine and a commitment to reducing carbon emissions, the emirate has set an ambitious target of generating 25% of its electricity from renewable sources by 2030. One key component of this effort is the adoption of solar rooftop in the commercial and industrial sectors.

To gain a deeper understanding of the solar rooftop market, we have collected and analysed geospatial data from Dubai’s most significant industrial zones. This analysis has become particularly relevant given that we are now eight years into the Shams Dubai programme launched by DEWA, and the market is reaching a point of saturation, with recent regulation updates slowing down the pace of solar adoption.

Such data analysis can offer valuable guidance for upcoming initiatives aimed at promoting the use of solar energy in the commercial and industrial sectors. The insights we have gained are particularly significant for companies and policymakers committed to promoting sustainable energy and reducing carbon emissions. By examining the sizes of rooftops and solar panel prevalence, we aim to draw insightful conclusions regarding the potential of similar markets worldwide. This, in turn, will help players in the solar industry to develop effective strategies to capture these opportunities.

Analysing Rooftop Sizes

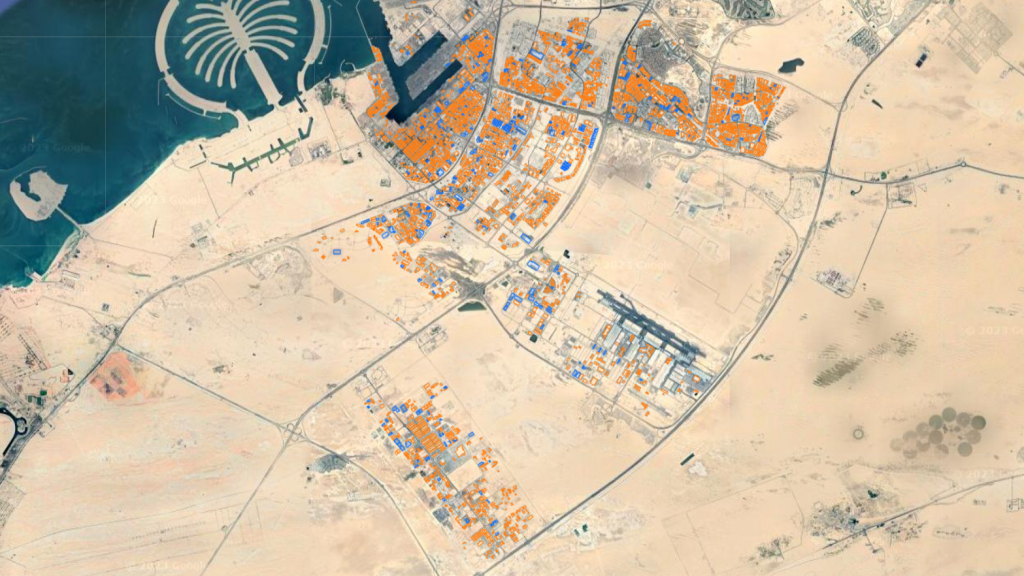

Jebel Ali is home to some of Dubai’s busiest commercial and industrial areas, which includes JAFZA, Jebel Ali Industrial Zone, DIP, Dubai South, DIC, and NIP. We honed in on these areas and analysed 4,538 rooftops, retrieving their geospatial information. By collecting data on geolocation, rooftop size, and the presence of solar panels, we were able to estimate the total solar capacity available in the area.

After excluding residential and office buildings due to their differing electricity consumption profiles and space availability, we’ve found that the total aggregated rooftop area in these industrial zones is a staggering 21 square kilometers, with an average roof size of 4,642 square meters. Based on an approximate calculation of 1.1 MWp of potential solar capacity per 10,000 square meters of rooftop area, we realised that Jebel Ali rooftops have the potential to accommodate an amazing 2.31 GWp of solar capacity.

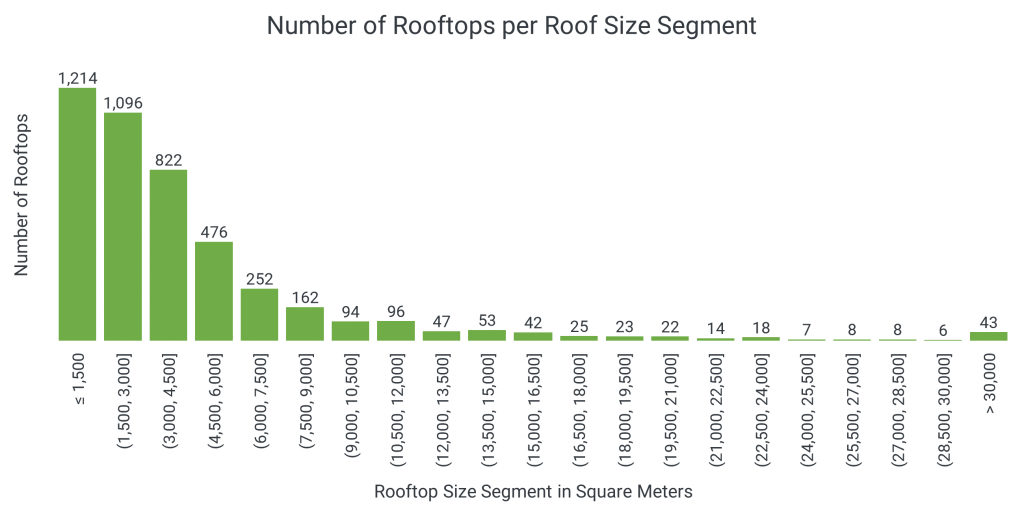

As we delve deeper into the potential for solar in the industrial zones of Jebel Ali, let’s examine the distribution of rooftop sizes.

A histogram chart, as shown in above, is a useful tool for visualizing this information. Each segment on the chart represents a rooftop area of 1,500 square meters, with most of the roofs falling into the smaller size category. In fact, a whopping 1,214 rooftops (27%) have an area of less than 1,500 square meters.

However, it’s worth noting that 43 rooftops exceed 30,000 square meters in size. This indicates that despite the majority of roofs being small, there is potential for solar capacity on larger rooftops. Further analysis reveals that despite the prevalence of small rooftops, around 100 rooftops have the potential for at least 2.5 MWp each.

Evaluating Rooftop Density

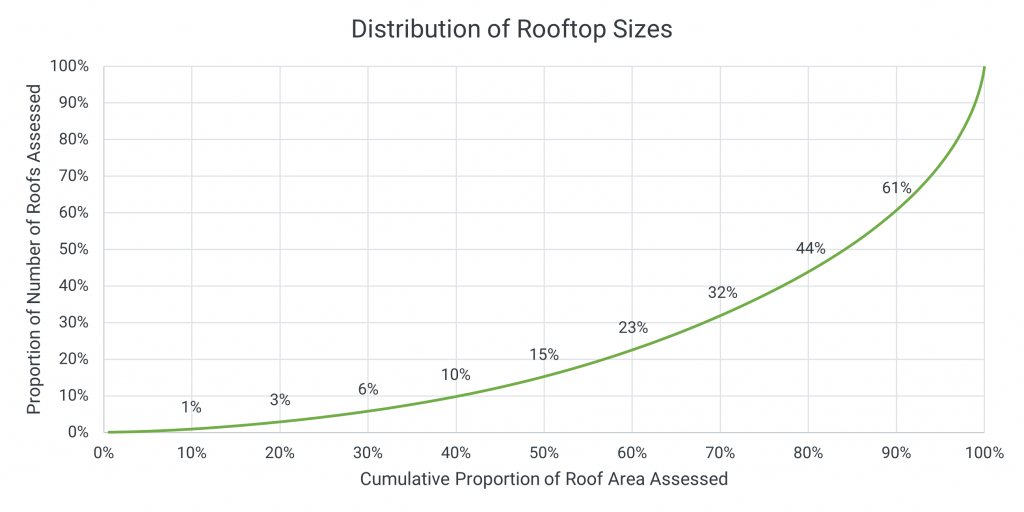

Upon analysing the rooftop sizes, we delve deeper into the density of rooftops. To visualize this, we created the below scatter chart that showed the cumulative rooftop area against the cumulative number of rooftops assessed, ordered from the largest rooftop to smallest.

The scatter chart analysis revealed a concentration of rooftop area in the largest 1,000 rooftops, covering almost 60% of the total area available. Conversely, the smallest 1,000 rooftops account for less than 5% of the rooftop area. The data also indicates that by focusing on the largest 30% of rooftops, solar companies could potentially access almost 70% of the available roof space in the Jebel Ali industrial zones.

Comparing Rooftop Segments and Solar Adoption

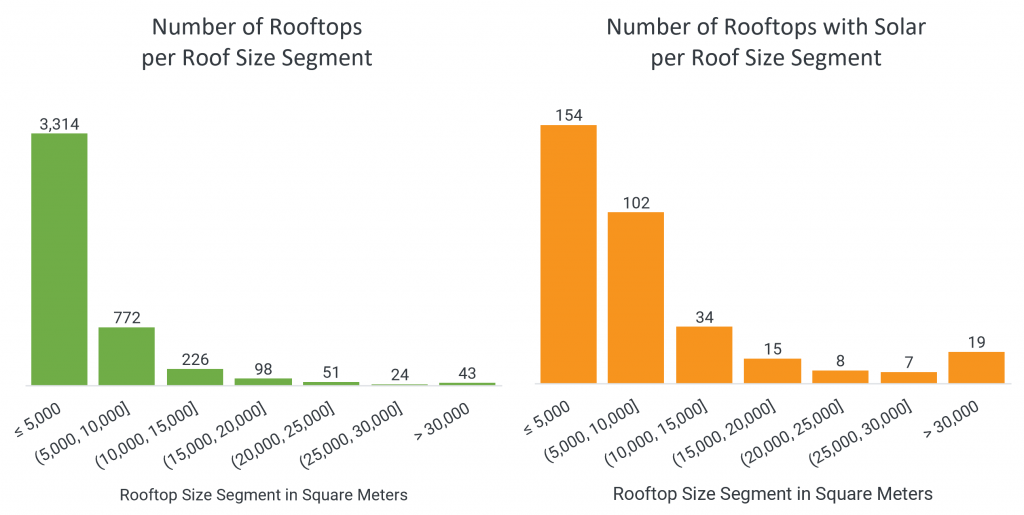

In the final phase of our analysis, we examined the distribution of rooftops and solar installations across different size segments in Jebel Ali’s industrial zones. The findings, based on the data presented in table and charts below, offer some noteworthy insights.

We’ve found that while there are fewer rooftops in the larger size segment (> 30,000 square meters), these rooftops have a higher percentage of solar installations (44%), indicating a greater likelihood of success for solar companies that focused on those customers. This is likely due to the economies of scale that come with larger installations, where customers can clearly benefit from cheaper solar energy. Furthermore, larger rooftops were found to contribute the most to the total rooftop area covered by solar installations, even though rooftops up to 5,000 square meters have the highest number of rooftops with solar.

The analysis suggests that focusing on larger rooftops could be a more effective strategy for those interested in investing in solar energy within Jebel Ali’s industrial zones. Specifically, targeting the 43 rooftops that are larger than 30,000 square meters could have yielded roughly 50-50 chance of successfully converting them to solar.

Using Data to Predict New Markets

Analysing geospatial data on solar power adoption can provide valuable insights for solar companies. By examining trends and patterns in solar installations, we are able to develop sales strategies that can be applied to similar markets. For instance, an analysis of geospatial data from Riyadh, Jeddah, and Damam suggests that a sales strategy based on these insights could lead to the success of at least 70 solar projects in Saudi Arabia. This is a result of the roughly 160 rooftops with an area of more than 30,000 square meters that can be found in those large cities.

Furthermore, understanding the potential solar rooftop market size is important not only for solar industry players but also for policymakers. With this information, policymakers can encourage the growth of the solar industry by implementing favourable policies, regulations, and targeted investment.

Geospatial data analysis of solar adoption in Dubai showcases the power of data-driven insights in predicting future solar trends. While examining the factors that drive solar adoption, both solar industry players and policymakers can develop effective strategies to promote the growth of the solar industry in emerging markets, paving the way for a brighter and more sustainable future.