Diesel generators have long been a mainstay of power generation in remote, off-grid locations. Its versatility makes them a popular choice where access to electricity may be limited or non-existent. However, that versatility comes with a costly environmental impact on carbon emissions and air pollution, and consequently on climate change and public health. Additionally, diesel generated electricity is subject to the volatility of global oil prices, bringing uncertainty into corporate energy expenses.

With the rise of renewable energy, the potential for decarbonizing diesel-generated electricity is now being widely explored. Solar energy presents itself as a sustainable alternative to diesel consumption, reducing carbon emissions and increasing resilience to fossil fuels volatility. Furthermore, solar power plants can be easily scaled to match the specific power requirements of a particular location or facility, creating room for increasing diesel generators optimization.

Solar developers have a crucial role to play in the transition away from diesel generation. But to be effective, they must identify the markets that match the qualifying conditions for the widespread adoption of those sustainable solutions and help businesses in switching from fossil fuels to a cleaner, more sustainable future.

In this article, we focus on the cost comparison between diesel- and solar-generated electricity in the GCC countries.

Diesel prices in the GCC

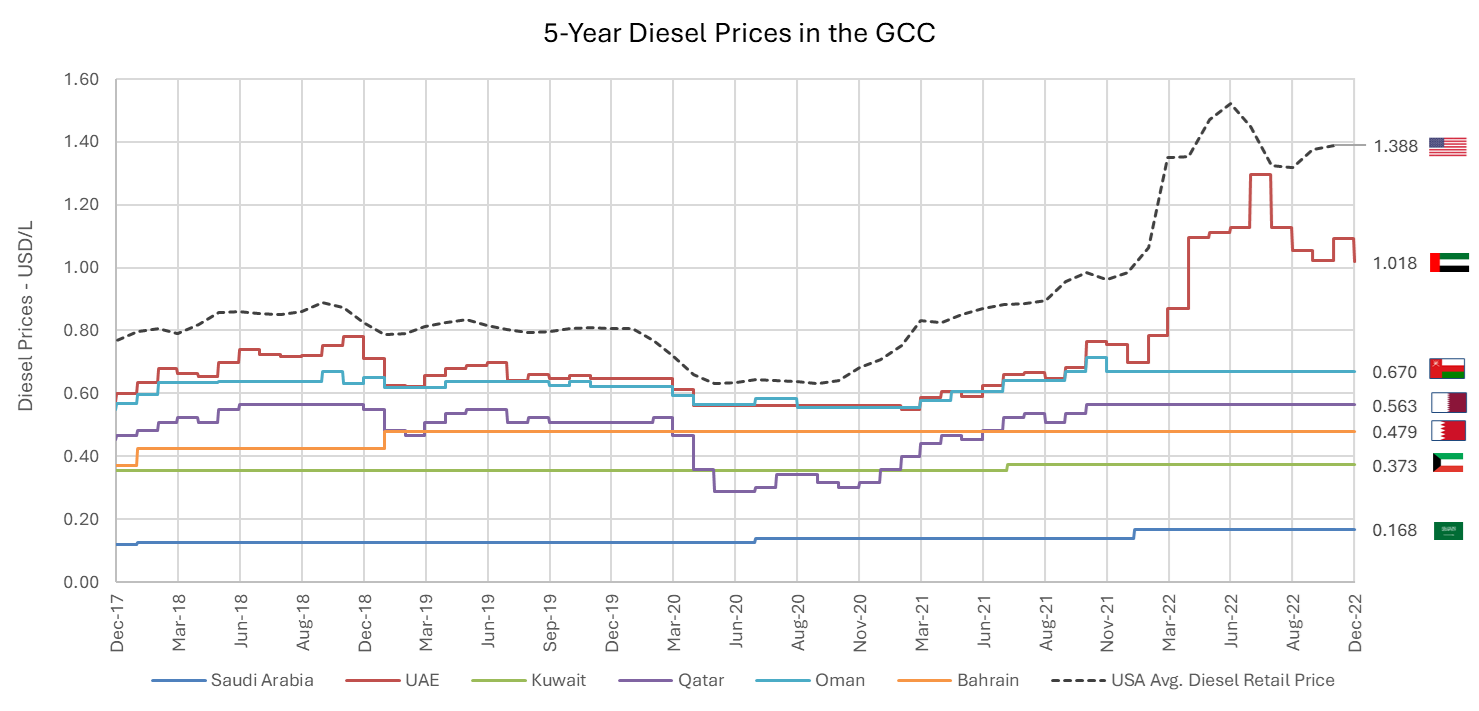

Major producers of fossil fuels, the GCC countries are globally known for their low pricing of energy. Although reforms have been implemented to remove subsidies, most of the GCC countries still have diesel prices below global benchmarks.

The UAE, Oman and Qatar have adopted energy reforms that brought diesel prices more in line with global benchmarks – although with varying degrees of subsidization. Saudi Arabia, Kuwait and Bahrain opted to maintain long-term stability of diesel prices through subsidies, effectively protecting their consumers from prices volatility.

The prices of diesel over the previous five years in GCC countries are shown in the chart below.

It is important to note that Oman and Qatar have not changed their diesel pricing since the end of 2021, despite having enacted energy reforms previously.

Diesel generated electricity

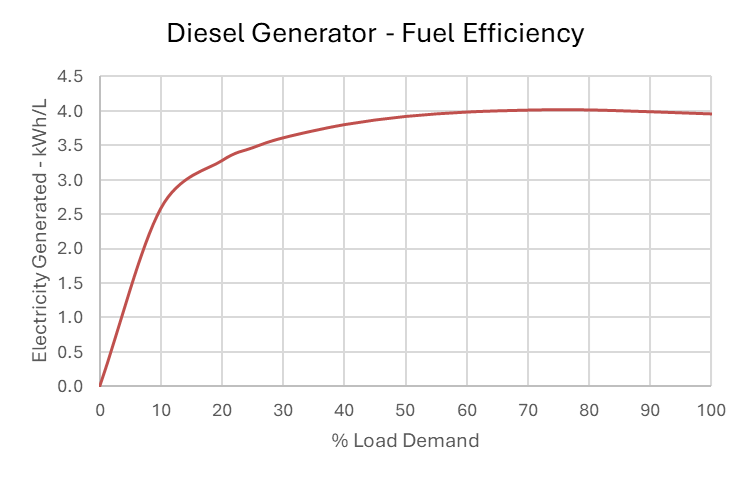

The efficiency of a diesel generator can vary depending on the load it is operating under. In general, diesel generators are most efficient when they are operating at or near their rated capacity, as this allows them to produce the most electricity per unit of fuel consumed. As the load on the generator decreases, its efficiency will also decrease. Additionally, using a generator that is properly sized for the intended application can also help to maximize efficiency.

The fuel consumption efficiency of a conventional diesel generator operating under various load demands is shown in the chart below. Assuming that a well-designed diesel generator is being used at the ideal load demand (60% to 90% of generator rated capacity), the diesel efficiency considered should be 4 kWh per litre of diesel consumed (or 0.25 L/kWh).

To simplify the calculation of diesel-generated electricity, I’m only considering the cost of diesel consumption. Nevertheless, we should be aware that the actual cost shall include the diesel generator’s cost of acquisition or leasing, as well as any required maintenance.

The cost of solar-generated electricity

Following the same approach as in this previous article, a reliable method to calculate the cost of solar-generated electricity is the Levelized Cost Of Electricity (LCOE). The LCOE is the ratio of all costs incurred throughout the lifetime of the power plant to the overall energy generated. It enables such comparison by capturing fundamental cost components including capital costs, operation and maintenance costs and discount rates.

I’m considering a solar system lifetime of 20 years and a discount rate of 8% for the calculation of the solar-only LCOE. I’m also considering that all electricity generated by the system can be used to offset the diesel-generated electricity, i.e. solar generation is not curtailed but fully utilized.

Diesel Generation vs Solar Generation

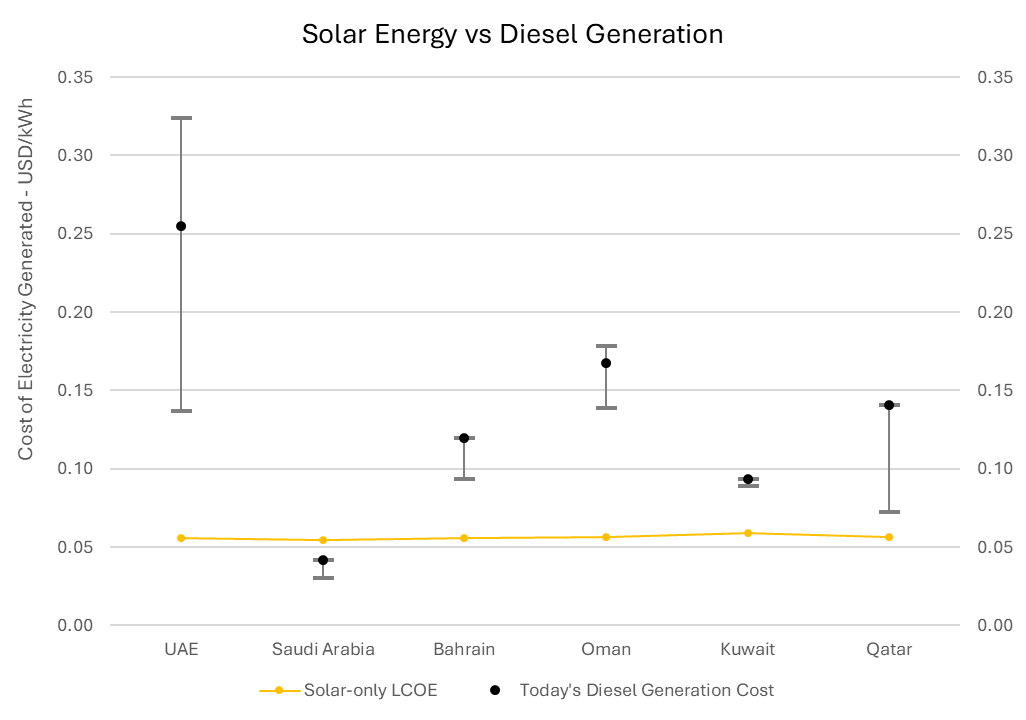

The chart below shows the comparison between the solar-only LCOE, in yellow, and the today’s diesel generation cost in each GCC country, as dark circle. The extended “whiskers” lines in the diesel generation cost reflect the range of diesel prices observed in the last 5 years.

With the exception in Saudi Arabia, solar energy is already the most affordable way to generate electricity in remote and off-grid locations in the majority of GCC countries, even when taking into account the changes of diesel prices in the last 5 years. In countries where energy reforms were introduced, the cost of solar-generated electricity can be as low as 50% of the cost of diesel generation with current diesel prices. Particularly in the UAE, solar generation can be even 75% lower, allowing substantial cost-savings to consumers.

However, Saudi Arabia’s low pricing policy reduces the financial incentive for companies to adopt solar energy as opposed to diesel power. The price of subsidized diesel must increase by 30% for unsubsidized solar electricity to catch up with diesel-generated electricity. From a practical standpoint, maybe subsidizing solar energy in off-grid applications could be a cost-efficient and environmentally friendly way for Saudi Arabian government to reduce the consumption of the heavily subsidized diesel fuel.

Please be aware that this analysis assumes a long-term perspective on electricity production, where long lifespan of solar energy match the business model of a facility using diesel generators. In the case of temporary power applications, such as in construction sites or events, a different approach may be required due to the specific requirements of these short-term business models. This will be the subject of a future article.

Targeting off-grid customers

Using solar energy to offset diesel consumption in the GCC countries is already a cost-efficient solution. Its ability to provide financial benefits to consumers is a critical success factor for the widespread of solar-diesel hybrid systems.

When comes to large-scale impact, only the countries with vast geographical areas – where electrifying all territory is almost an impossible mission – can create markets with long-term, reliable pipeline of customers for solar developers. Further investigation is required on this, but countries as Saudi Arabia and Oman show a more promising pipeline of projects.

All of these factors must be taken into account by solar developers, who must pick markets that will allow them to build scalable portfolios while maintaining a balance between the appeal to their customers and their own pipeline.