As distributed solar developers push to expand their geographic reach and increase their market share, competition with conventional technologies intensifies. Solar not only seeks to reach parity with utility electricity tariffs, but aims to surpass it to provide investors with a yield for its large upfront capital and long term investment requirements.

The Gulf Cooperation Council (GCC) countries can be an ideal market for distributed solar. The case for rapid deployment of solar energy is theoretically stronger in the GCC region than in many other developing economies, since it has one of the highest solar exposures in the world, while being a major consumer of energy with a rapidly growing population pushing further electricity demand ever higher. The region additionally enjoys the benefits of healthy investment ratings, currency stability and capital availability, all of which allow for the flourishing of a bankable model for private investment into solar power.

Although important, these factors alone are not sufficient to ensure the success of the distributed solar business in the GCC. A deeper look into the electricity market is needed to understand which regions justify attention from solar developers.

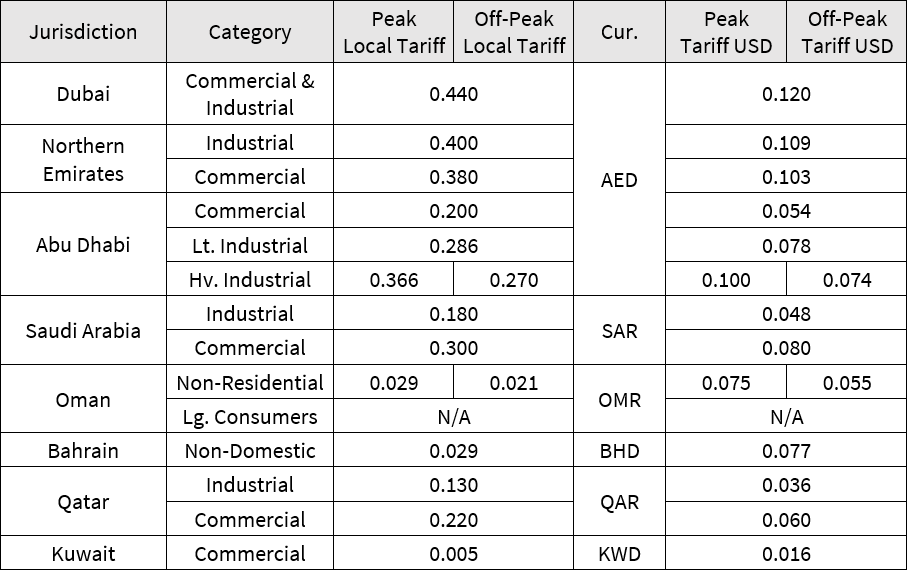

The electricity tariffs across the GCC

The dominant approach to power pricing in the GCC was developed during the last century’s oil boom, amid government revenue surpluses. Subsidizing electricity was an effective way of directing some of that surplus to industry and citizens, leading policymakers to make use of the overabundance of oil to create wealth and spur growth for the national economy.

Today, the effects of these policies are seen in economies highly dependent on subsidized electricity: with electricity prices being kept artificially low, subsidies have increased overall demand while disincentivizing end users to increase the efficiency of their energy usage and production.

The GCC electricity market has been primarily driven by monopolistic, government-controlled utility companies. The electricity pricing structure is often based on flat or consumption-slabbed tariffs, while some also include a peak rate for the summer seasonal usage.

- Source: Dubai, Northern Emirates, Abu Dhabi, Saudi Arabia, Oman, Bahrain, Qatar, Kuwait

The cost of solar generation

The downward trend in solar photovoltaic panel costs has been an important driver of improved competitiveness for solar-generated electricity. However, after several years of downward price trends, solar panel costs have increased since 2020, driven by supply chain disruptions amid the 2020/2021 global pandemic.

Nevertheless, the increased efficiencies of solar panels and the unprecedent learning curve and economies of scale in the region are leading to an increased competitiveness of solar generation in the commercial and industrial sectors.

Although it can change between geographies, the cost of a standard solar rooftop application in a commercial or industrial facility vary between 700 and 850 USD/kWp, while the operation and maintenance costs fall between 17 and 20 USD/kWp/year.

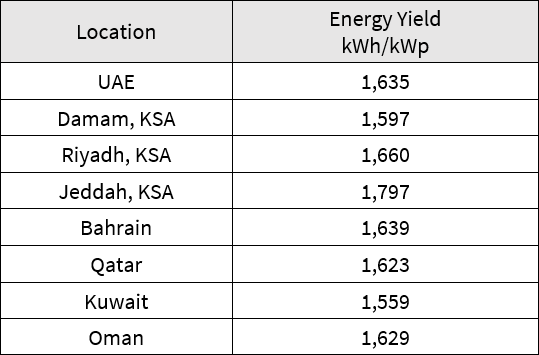

Additionally, the privileged location of the GCC countries in the global sun-belt provides an exceptional solar irradiation, allowing energy yields up to 1,800 kWh/kWp for rooftop solar systems.

The Levelized Cost Of Electricity

The primary calculation to determine the commercial viability of behind-the-meter solar energy systems is to compare the cost of solar electricity with the existing commercial and industrial electricity tariffs.

Since the commodity that “fuels” solar generation systems is “free” solar irradiation, the capital expenditure becomes a critical element of that equation. Relatively low operations and maintenance costs and a long-term operating life underlines the main economics of solar-generated electricity: long-term yield used to amortize a large upfront investment.

The Levelized Cost Of Electricity (LCOE) is still a prevalent metric used in the energy sector for cost comparison purposes. The LCOE is the ratio of all costs incurred throughout the lifetime of the power plant to the overall energy generated. It enables such comparison by capturing fundamental cost components including capital costs, operation and maintenance costs and discount rates.

For the calculation of the Distributed Solar LCOE, we considered a solar system lifetime of 20 years and a discount rate of 8%. Also, to simplify the calculation and its results, we should consider that all electricity generated by the system can be used to offset the premise’s consumption, either by direct consumption or through public policies such as net metering.

The Distributed Solar LCOE vs GCC Electricity Tariffs

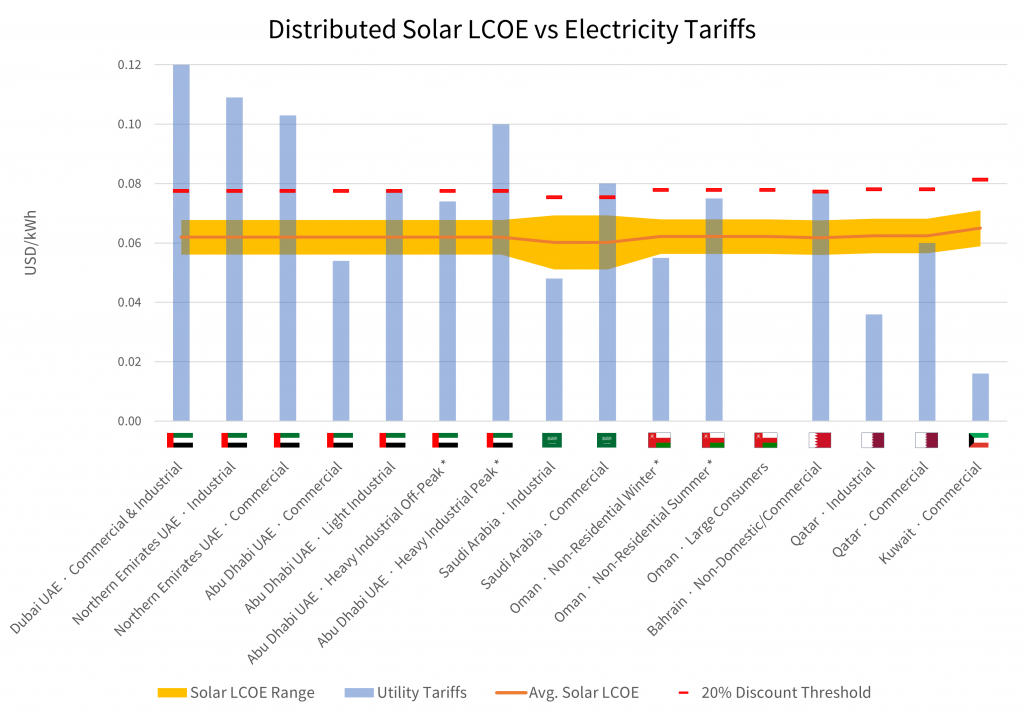

The chart below shows of the comparison between the Distributed Solar LCOE and the GCC Utility Tariffs. The blue columns represent the utility tariffs in each market-category, and the yellow band represents the Distributed Solar LCOE range, considering the maximum and minimum costs of the solar rooftop systems and the different location-based solar irradiation. The orange line represents the Average Distributed Solar LCOE.

Despite the already competitiveness of Distributed Solar in several GCC countries, being par with the utility tariff is not sufficient for a successful distributed solar business: experience shows us that a 20% savings discount threshold (marked in red) would be a key trigger to peak a customer’s interest in adopting solar. Therefore, places such as Dubai and the Northern Emirates can be perceived as the markets with the highest potential, followed by Bahrain, the industrial sector in Abu Dhabi and the commercial sector in Saudi Arabia.

However, caution is advised: whereas most of these markets have adopted solar energy policies, the Northern Emirates currently do not have a framework for solar systems, and Saudi Arabia adopted a less rewarding net billing policy.

For the remaining GCC markets where utility rates are below the above threshold, distributed solar remains a challenge. In highly subsidized environments, such as Kuwait, Qatar or the industrial sector in Saudi Arabia, a combination of electricity subsidies reduction, increase solar panel efficiency, and further cost-efficiency of solar systems are required to truly catalyse demand from the commercial and industrial segments and become commercially viable in the future.

Focus is key

Although organizations are gradually procuring energy from renewable generation sources as part of their sustainability strategies, the economics of solar energy still play the main role in its adoption.

Regional governments have been promoting renewable energy while setting ambitious sustainability goals. However, highly subsidized environments end up disincentivising private sector leadership in adopting renewable sources of electricity, despite the region’s exceptional solar irradiation and strong commercial and industrial sectors.

Distributed solar developers should be very aware of those market circumstances. Focusing their resources where distributed solar makes sense might prove to be the competitive advantage to expand their geographic reach and increase their market share.